- 16.01.2022

- Posted by: admin

- Category: Сведения о СЭЗ "Панч"

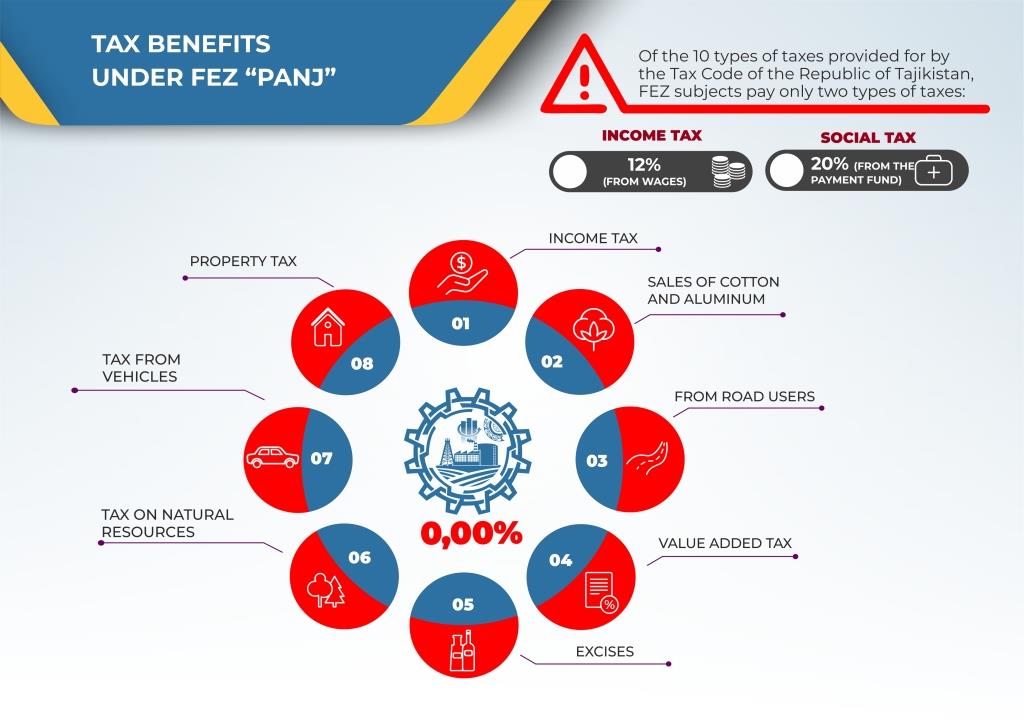

On FEZ territory entrepreneurship activity of FEZ subjects regardless of ownership forms, is free from all kinds of taxes payments provided in the Tax Code of the Republic of Tajikistan, except social tax.

The social and income tax of persons hired shall be charged and paid by the FEZ entities in an independent manner in accordance with the Tax Code of the Republic of Tajikistan.

Profit received by the foreign specialists and their salary received in foreign currency, can be easily transferred to abroad and will not be taxed.

The tax exemptions are valid only in that part of the activity of entities, which shall be carried out on the territory of the free economic zone. Taxation of the activities outside the territory of the free economic zone shall be on a common basis in accordance with the tax legislation of the Republic of Tajikistan.

Subjects of free economic zones shall be taxpayers and shall maintain own accounting records of their financial and economic activity.

Provision of electricity, water supply, sewerage and other public resources in the territory of FEZ is carried out without value added tax and other types of taxes in force in the territory of the Republic of Tajikistan.